Lagos Address

Plot 954a, Idejo Street, Off Adeola Odeku Street, Victoria Island, Lagos

Work Hours

Monday to Friday: 9AM - 4PM

Lagos Address

Plot 954a, Idejo Street, Off Adeola Odeku Street, Victoria Island, Lagos

Work Hours

Monday to Friday: 9AM - 4PM

This is the third installment in our 5-part “Investing In Nigeria” series. The first was on “Mutual Funds” and the next “Stock“. Here at Mainstreet Capital, we began this series to get us all more aware of our investment options and get us to a point of financial freedom.

Today, we will talk about Money Market fund.

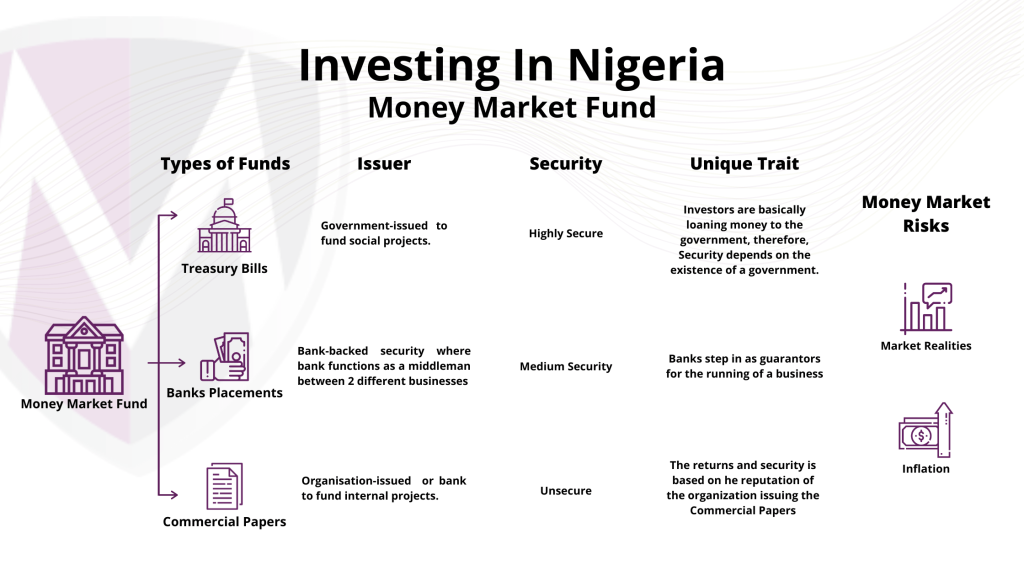

A money market fund is also called a money market mutual fund. It is an open-ended mutual fund that invests in short-term, low risk debt vehicles like Treasury Bills, Bank Placements and Commercial Paper. Money market funds are managed with the goal of maintaining a highly stable asset value through liquid investments, while paying income to investors in the form of dividends. In addition, the money market often generates a low single-digit return for investors, which in a down market can still be quite attractive.

It is important to note that the investment minimum are lower than other investment types so barrier-to-entry is low.

Money Market funds are not insured against loss and actual losses are rare.

Unlike certain funds, Money Market Funds don’t generally invest in securities that trade small volumes or few buyers. They mostly trade in securities that are in fairly high demand (such as T-bills). This means they tend to be more liquid and as a result, investors can buy and sell them with comparative ease.

Because of how unstable the stock market can be, Money Market funds are relatively safe places to park money in spite of the single digit returns.

Potentially, inflation can hamper value of investments over time

There are numerous Money Market instruments like Commercial Papers, Treasury Bills and Placements (private placements, bank placements), Bankers Acceptances and Certificate of Deposit

This is dependent on market realities, demand and supply and the economy’s health.

As of May, 2020, Treasury bills returns was 1.90%. For Savings Deposits, the interest changes depending on the duration of the investment. For 1 month, 3.33%, for 3 months, 4.7% and 6 months, 4.98%.

How can you get it?

You can sign up with a commercial bank or talk to the Asset Management Team here at Mainstreet Capital. Also, you can open an account with us here.

To Stay tuned for more updates; follow Mainstreet Capital Limited on social media ( LinkedIn | X | Instagram | Facebook ). Remember, the more you learn, the better equipped you’ll be to make sound investment decisions. For more information or personalized investment strategies that take advantage of the new economic realities, book a session with our expert asset managers.