Here at Mainstreet Cap HQ, we have decided to put together a small series to help our investors and other readers understand what we do with their money and the options on how they can grow their investments to financial freedom. This series will span a few weeks as we highlight the different kinds of investments available locally and how you can tap into the opportunities.

Before we delve in deeply, let’s get a basic understanding of what Investment means.

Investment is the act of putting money to work by starting or expanding a business or project to the purchase of an asset, with the goal of earning income or capital appreciation. Investment has the future in consideration and has a level of risk involved.

A mutual fund is made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets.

Investing in a mutual fund means that you have a part of the portfolio’s value. Investing in a share of a mutual fund is different from investing in shares of a companies stock. Unlike stock, mutual fund shares do not give its holders any voting rights.

One share of a mutual fund represents investments in many different stocks (or other securities) instead of just one holding.

Income is earned from dividends on stocks and interest on bonds held in the fund’s portfolio. A fund pays out nearly all of the income it receives over the year to fund owners in the form of a distribution. Funds usually give investors a choice either to receive a check for distributions or to reinvest the earnings and get more shares.

If the fund sells securities that have increased in price, the fund has a capital gain. Most funds also pass on these gains to investors in a distribution. A capital loss is the opposite of a capital gain and this loss is divided between the investors.

If fund holdings increase in price but are not sold by the fund manager, the fund’s shares increase in price. You can then sell your mutual fund shares for a profit in the market.

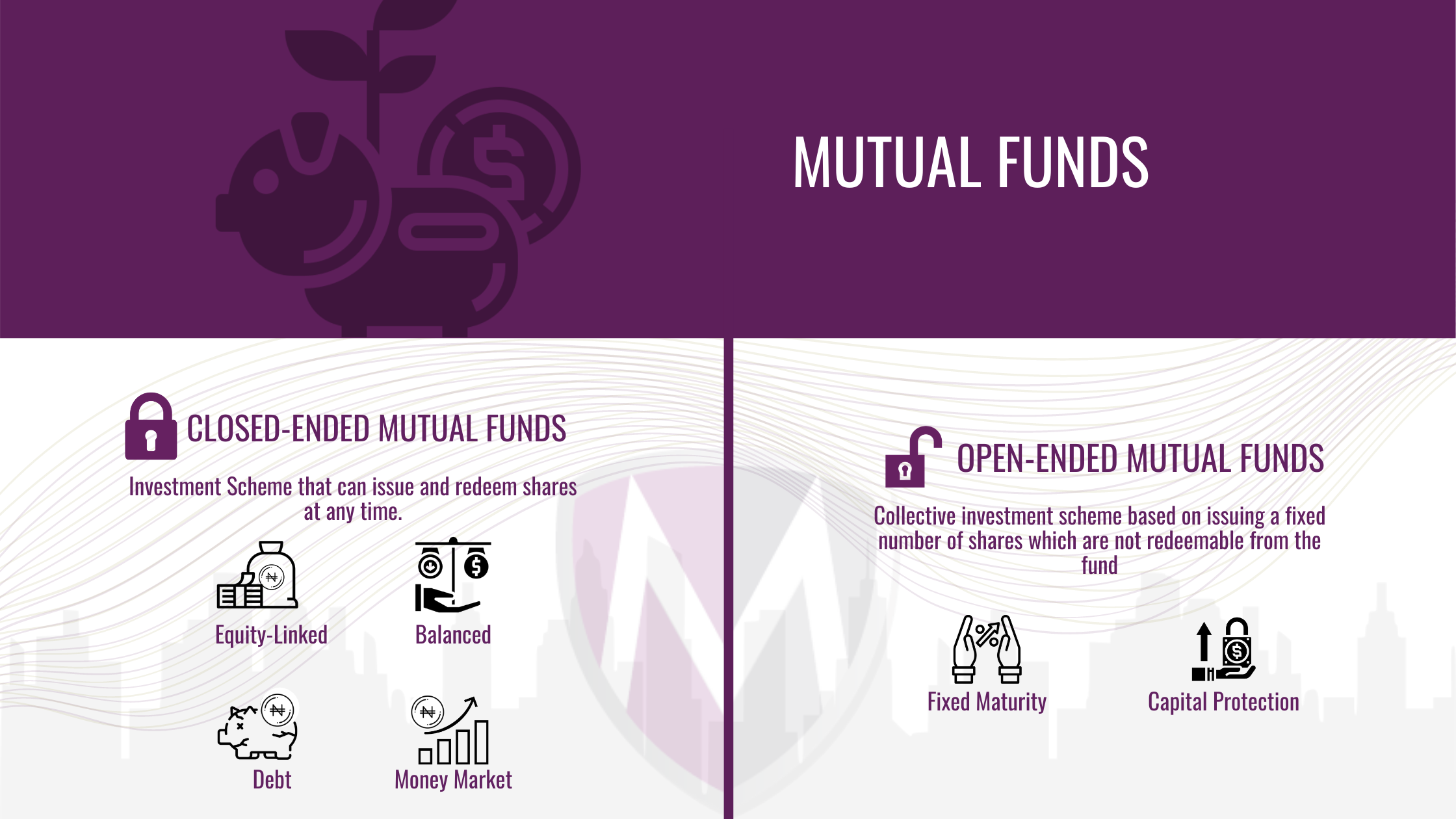

Investment Scheme that can issue and redeem shares at any time. An investor will generally purchase shares in the fund directly from the fund itself, rather than from the existing shareholders. Open-end funds determine the market value of their assets at the end of each trading day.

Examples-

Investment Scheme that issues at the outset all the shares that it will issue, with such shares usually thereafter being tradeable among investors.

Examples