Lagos Address

Plot 954a, Idejo Street, Off Adeola Odeku Street, Victoria Island, Lagos

Abuja Address

6th Floor, Sterling Plaza, Plot 1083 Muhammad Buhari Way Central Business District, FCT Abuja

Work Hours

Monday to Friday: 9AM - 4PM

Lagos Address

Plot 954a, Idejo Street, Off Adeola Odeku Street, Victoria Island, Lagos

Abuja Address

6th Floor, Sterling Plaza, Plot 1083 Muhammad Buhari Way Central Business District, FCT Abuja

Work Hours

Monday to Friday: 9AM - 4PM

What do Financial Risk and Reward Mean?

Financial risk is the possibility of losing money on an investment or business venture. Risk and reward go side-by-side with investing.

Financial risk and reward is the prospective ratio in which an investor can earn or lose from every amount that flows into an investment. According to research, “regardless of the type of investment, there will always be some risk involved. You must weigh the potential reward against the risk to decide whether it’s worth putting your money on the line”.

Understanding the relationship between risk and reward is a crucial piece in building your personal investment philosophy.

“Risk” in this case, simply refers to the potential uncertainty involved when making investment decisions. These types of risks include Business risk, Volatility risk, Inflation risk, Interest rate risk and liquidity risk.

Furthermore, the distinction of risks varies on the product, market, Investment plan and target of both the platform and the investor. Every investor’s focus is on how to build wealth and maximize profit, while minimizing risk.

The “wealth” stated above signifies “reward”. This is the potential outcome that comes because of a risk taken by an individual, investor, company, bank, Government, or financial institution. It is more often accurate that the greater the risk, the greater the potential reward. Whereas, if an individual or investor takes a smaller risk, they are more likely to earn a small reward. This principle is known as Risk/Reward Ratio.

How the Risk Reward Ratio Works

As an investor, having a good risk/reward ratio is very ideal. Even many highly experienced individuals have lost a fortune due to not managing their risks appropriately.

The risk reward ratio is an effective risk management tool that should be used before entering any position. It sets the mark for the reward in which any investor can earn on every naira they risk on an investment.

For instance, a risk-reward ratio can be equivalent to 2:5, in which the amount put in the investment is 2 while the expected return is 5. The investments portrays the “risk” the investor is willing to take while the returns signifies the potential “reward”. It is important to take note of critical factors that could influence the risk of an investment. Factors like the political climate for instance or technological advancements could make or break investments.

Most calculative investors use a reward strategy ratio of 1:1. This illustrates a case where if an investor is comfortable losing ₦50,000, they can invest this amount with a goal of making a profit of ₦50,000. Technically, they will either lose or earn ₦50,000 on that investment.

Another ideal action for any investor is to have a stop loss. This is simply setting a threshold on your risk limit. It is a tool that automatically stops a transaction when it gets to a certain loss point. For instance, an investor wants to invest ₦500,000. They can set a stop loss limit of ₦200,000 which signifies the risk they are willing to embark on if the investment is not fruitful. When the investment crashes by ₦50,000 thereabout, they can partially be safe. But if the loss gets to about ₦200,000, they are made aware and can decide to sell the shares, putting a stop to the loss.

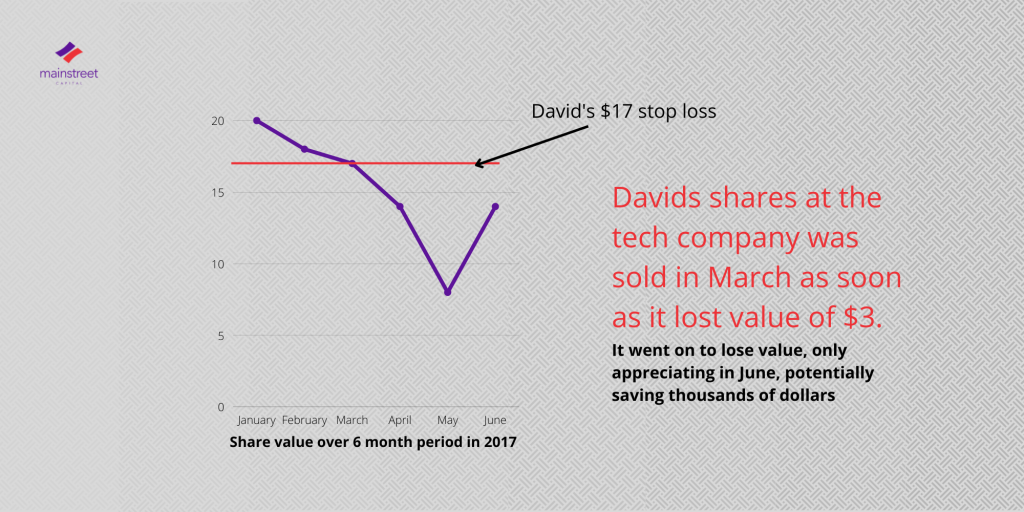

Example Of a Stop Loss

Suppose David just bought 2,000 shares in a tech company at $20 per share in January 2017. Soon after purchasing the stock, David enters a stop loss order in his trading app for $17. If the stock falls below $17, David’s shares will then be sold at the current market price but will remain in trade if it grows in value or the loss stops at $18.

What is an Investment Portfolio ?

According to a research, an investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash equivalents, and commodities held to earn a profit while making sure that capital or assets are preserved.

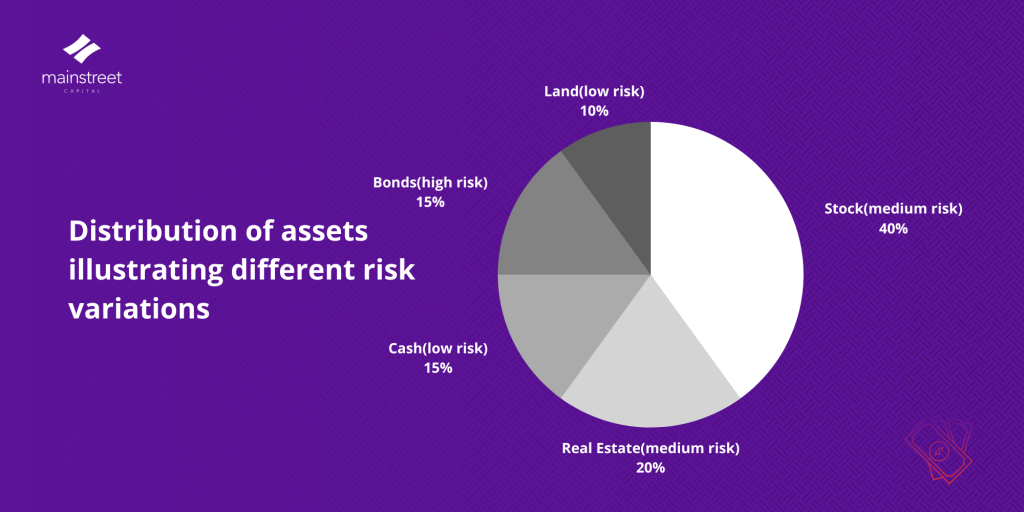

Remember the saying, “don’t put all your eggs in one basket”. It contextually applies here. Balancing risk in one’s portfolio means realizing how much exposure one is willing to have in the emergence of an investment not working accordingly. More importantly, an investor needs to maintain a decent balance of his or her assets, which helps to foster the growth of stocks and control the risks. There are different types of portfolios, these include :

See below, a sample of an investment portfolio distributed across the open market and alternative investments.

How to maximize reward while minimizing risk with a Diversified Portfolio

Minimizing risk while maximizing reward is the ultimate goal for any investor. The smartest and most important thing an investor can do is understand which risk elements constitute the most impact on your investing strategy. Having a solid investment strategy entail developing an investment plan; which should include 5 key principles:

Most people evaluate their investments often. However, regardless of how much you calculate your decision, it is crucial to understand your appetite for risk in relation to the reward you want. Building an ideal diverse portfolio to manage your investments is significant. It is a smart financial move that manages riskier and conservative investments.

Reaching out to financial firms or Investment banks for solutions is a major step towards minimizing risk and maximizing your reward. These days, financial services are technology driven. This helps to ensure easy, innovative and satisfactory solutions for investors. A leading firm in this industry is Mainstreet Capital. The financial technology firm provides advisory strategies, debt advisory, Interest rate solutions and alternative investments for businesses, governmental institutions and investors. You can reach out to them here.

“The biggest risk is not taking any risk” – Mark Zuckerberg

John is a data analyst. John works at Horizon Limited. John goes to work only on weekdays and earns a monthly salary of ₦1,000,000 after tax. He also has a commercial agriculture business which brings in an estimate of ₦2,000,000 profit monthly. However, he has always been one to squander his income and engages in no form of investments.

After viewing an article online, John ponders to himself on how much he is doing with his income, so he decides to receive financial advice. He decides to budget his income, allocating monthly operations for ₦900,000 at 30% of his monthly income of ₦3,000,000, while Leisure is budgeted at the same amount and percentage allocation, leaving 40%, being ₦1,200,000 monthly for his investments. His reasoning is to allocate his income for a healthier financial portfolio.

Total income – ₦3,000,000

Monthly Operations – ₦900,000

Leisure – ₦900,000

Investments – ₦1,200,000

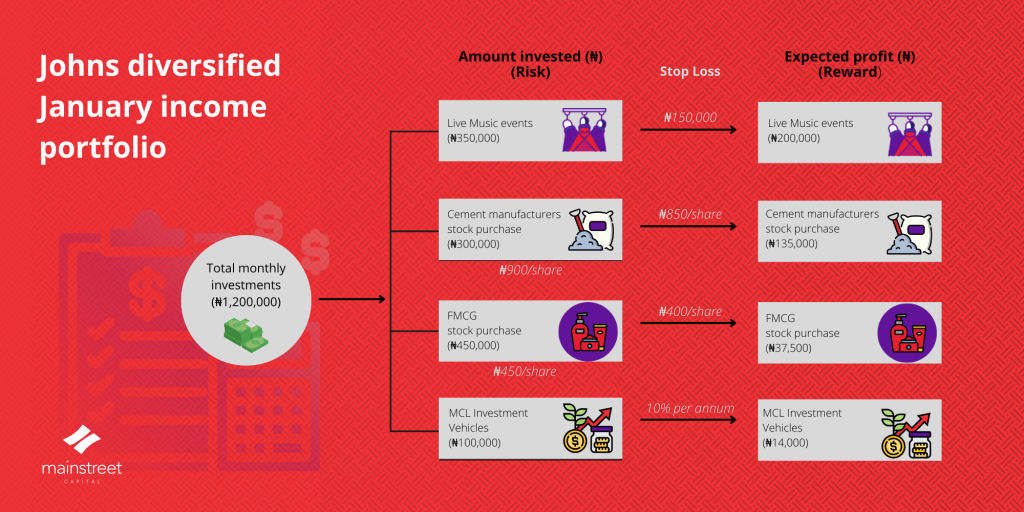

The table below illustrates Johns new financial investment strategy.

January

| Allocation/Stock | Share Amount invested | Tenure | Expected Returns on Investment | Expected Yield | Expected Profit | Stop Loss order |

| Live Music shows in Lagos | ₦350,000 | Quarterly for 1 year | 63% ROI per show | ₦550,000 per show | ₦200,000 per show ₦800,000 per year | ₦150,000 per event, but if it runs a loss twice in a row, no more investment |

| Shares in cement company | ₦300,000 at ₦900/share | 1 year | 15% share increase | ₦345,000 | ₦45,000 | ₦850/share |

| Shares in a prominent FMCG | ₦450,000 at ₦500/share | 1 year | 7% share increase | ₦481,500 | ₦31,500 | ₦400/share |

| Mainstreet Capital Investment vehicles | ₦100,000 | Monthly for 1 year (Totaling ₦1,200,000) | 10% per annum, compounding every quarter (Read more about the power Compound interest here) | ₦1,320,000 (annum) | ₦120,000(annum) | 10% per annum |

Johns Finances in January:

Total Capital investments – ₦1,200,000

Total Yield – ₦1,416,375

Total Profit – ₦216,375

Diverse portfolio in Shares, Open market, Alternative investments

This investment strategy has enabled John to be more economical and make wiser decisions with his finances. Now John has a risk percentage of 20% with his finances which has a potential reward of 5% monthly from investments particularly. Moreover, John who is now an investor makes use of a stop loss order which helps to set a stop to his investments if shares are going downwards.

The risk reward ratio is also evident as John takes a bigger risk in investing more in real estate with the goal of earning a greater reward.

John is now happier and feels more satisfied with himself for this decision. He is quite optimistic about the future and is in a better position to make wiser decisions on his finances.

Conclusion

Living in a country where there is high inflation and the currency value is depreciating, one would need to stay above board so as not to be on the losing end with their finances. Inflation is when the prices of commodities go up over time, which makes the value of money go down.

For example, If your salary was ₦300,000 in 2018, it is now worth ₦100,000 in 2022. It has depreciated by a significant percentage between 2018 and 2022. (Inflation rate is expressed as a percentage). Consider the following means to protect your finances:

“Living in fear stops us from taking risks, and if you don’t go out on the branch, you’re never going to get the best fruit”. – Sarah Prish

To Stay tuned for more updates; follow Mainstreet Capital Limited on social media ( LinkedIn | X | Instagram | Facebook ). Remember, the more you learn, the better equipped you’ll be to make sound investment decisions. For more information or personalized investment strategies that take advantage of the new economic realities, book a session with our expert asset managers.