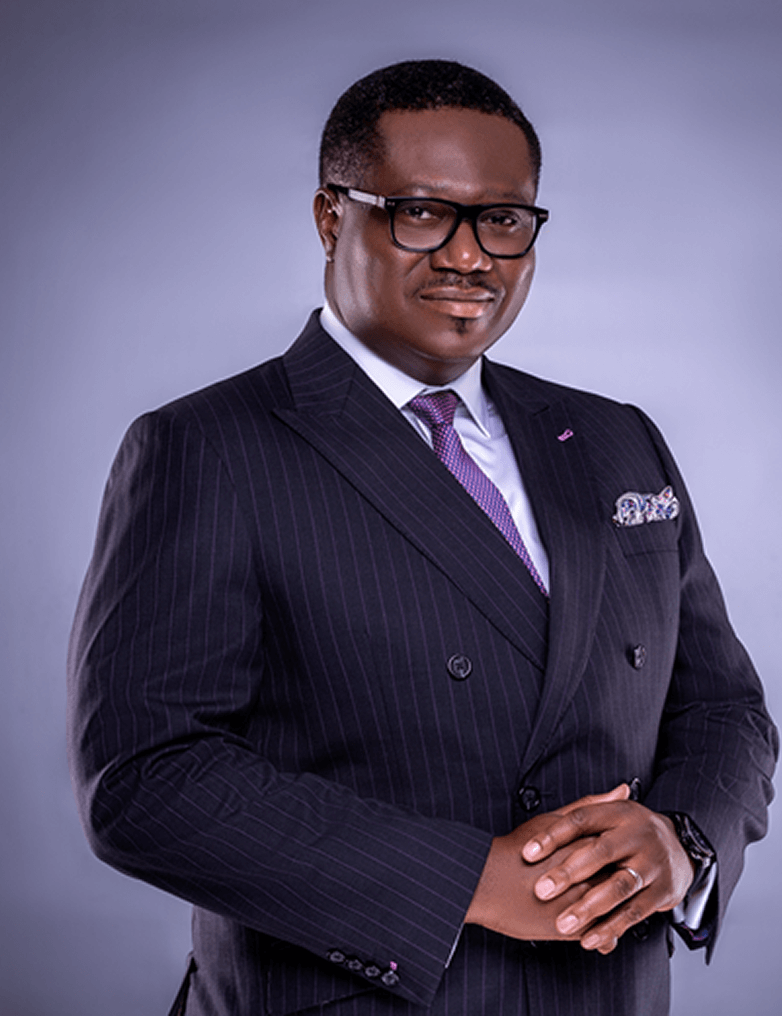

Managing Director

Ebi Enaholo is an astute investment banker with over 17 years of experience across financial advisory, project finance, capital issues, securities analysis, mergers and acquisitions and capital market operations in the Nigerian financial services sub sector. He is the Managing Director of Mainstreet Capital Limited. His experience over the years has exposed him to various facets of corporate finance, mergers and acquisitions and project finance

Founder and Chief executive of Camden Yards Investments Limited- A fast growing business and financial advisory firm in Nigeria, before he assumed this new role.

Head, Research Department of City Finance & Securities Limited (a subsidiary of City Express Bank Plc) in 2004.

Joined Investment Banking Division of Greenwich Trust Limited in 2005 and exited as the Executive Director

Member, Securities and Exchange Commission sub-committee on rules and regulations in recognition of his experience in the Capital Market.

Director of Administration of the Association of Issuing Houses of Nigeria (AIHN) in 2013.

Chief Operating Officer of Eurafric Sapele Power Plant Plc in April 2014. Non-Executive Director of Niger Insurance Plc, Camden Yards Investments Limited Chairman, Zotam Farms Limited, Gourmet Nibbles Limited and Danik Bureau De Change Limited.

He holds a B.Sc. in Economics from the Ambrose Alli University and is an Alumnus of the prestigious Lagos Business School. He is a Fellow of the Association of Investment Advisers and Portfolio Manager and also a member of the Chartered Institute of Stockbrokers. He has attended several domestic and international courses pertaining to Equity & Debt Capital Markets, Corporate Finance, Project Finance and Portfolio Management.

Some key transactions handled by Ebi Enaholo

Project Coordinator, Local Contractors Receivable Management Limited N116 Billion (Tranche II) Bond Issuance (2012)

Transaction member in the United Bank for Africa Plc N20 Billion Corporate Debt, First Tranche – (2010)

Project Coordinator, N9.3 Billion Recapitalisation of Wema Bank Plc (2010)

Team Leader, Sale of 40% Equity Stake of DN Meyer Plc to new Core Investors (2010)

Project Coordinator, Local Contractors Receivables Management Limited N360 Billion Debt Issuance Programme. First Tranche N112Bn (2011)

Project Coordinator, Ekiti State N25 Billion Debt Issuance Programme. First Tranche N20 Billion (2011)

Transaction member, AMCON N1.7 Trillion Debt Issuance programme (Tranche II)(2011)

Lead Adviser, Wema Bank Plc Divestment Exercise from its Subsidiaries (2011)

Lead Adviser, Access Bank Plc Divestment Exercise from its Subsidiaries (2011)

Transaction member in the Delta State N100 Billion Debt Issuance Programme-First Tranche N50 Billion

Sole Adviser and Co-Team Coordiantor, Tourist Company of Nigeria Plc N5.2bn Core Investor Sale (Sun International, SA), 2009

Transaction Member and Coordinator, NAHCO Aviance N5bn Issuance Programme, 1st Tranche of N2.15bn, 2011

Team Lead, Aiico Insurance Plc N5 Billion Public Offer 2008

Lead Adviser, Sovereign Trust Insurance Merger with Confidence Insurance, Coral International Insurance and Prime Trust Insurance