In this article, we have a range of updates from Donald Trump’s victory in the 2024 U.S. Presidential election and its impact on global markets, to Nigeria’s evolving budgetary concerns, fluctuations in oil prices, and the latest financial market developments.

Trump’s Election: Making America Great Again?

On November 6th, Donald Trump won the 2024 U.S. Presidential election, defeating Kamala Harris in a politically charged race. US equities market indices like the S&P 500 and Dow Jones have trended higher since the elections as the nation responds to Trump’s incoming economic policies.

We’ve highlighted some important ones below.

Tariffs and Global Trade: The president-elect said that he would impose tariffs on goods from certain countries until Canada, Mexico and China halt the flow of drugs and migrants. Some of these tariffs include a 25% tariff on goods from Canada and Mexico and a 10% tariff on goods from China.

The tariffs would also have implications for American industries, including manufacturers, farmers and consumer goods companies. Mexico, China and Canada together account for more than a third of the goods and services (both imported and exported) by the United States, supporting millions of jobs.

While this is not a supported by all parties and stakeholders (consumers, business owners), Trump emphasizes an “America first” stance for trade. We’ll keep an eye on the situation.

Key Appointments & Economic Plans: Trump is breaking the mould with his cabinet picks. One thing that’s clear is his sidestepping career politicians for what appears to be political outsiders, and this has Washington a little worried.

Trump nominated Scott Bessent, a former hedge fund manager, for U.S. Treasury Secretary. Some of Bessent’s economic ideologies are in tandem with Trump’s. The Treasury secretary nominee believes in reducing government deficit and deregulating industries to promote economic growth. The coming administration’s focus on revitalizing the energy and financial sectors could have far-reaching effects.

What Else Happened in the United States

• US job growth slowed in October, and speculation is growing that the Federal Reserve may pause its aggressive rate cuts.

• The Fed’s recent 25 basis point interest rate cut to 4.5% was largely expected, but it had little effect on dousing the strength of the dollar as the buzz from incoming administration’s planned policy continues to bolster the DXY.

• The Fed rate cut is expected to be less aggressive following inflation data for October which printed 2.6%, higher than the 2.4% printed in September.

Oil Prices: Geopolitical Tensions, OPEC Forecast and Hurricanes

Crude oil has been on a rollercoaster ride recently, with price swings driven by geopolitical conflicts and the impacts of hurricane Helene. The recent ceasefire between Israel and Hezbollah has brought a sigh of relief to oil markets although supply concerns remain as the Trump’s administration plans to increase production.

Meanwhile, China’s oil demand has slowed because of rising sales of new energy vehicles, economic deceleration due to a struggling real estate sector, and sluggish demand for Chinese exports.

The year has been marked by intense conflict between Israel and Hamas and Russia and Ukraine, which have kept oil prices volatile. On the other hand, OPEC is still holding back on production increases, but with tensions in the Middle East, OPEC expects global oil demand to rise by 1.82 million barrels per day in 2024, a slight drop from previous projections of 1.93 million barrels per day.

Moving on to other global economies.

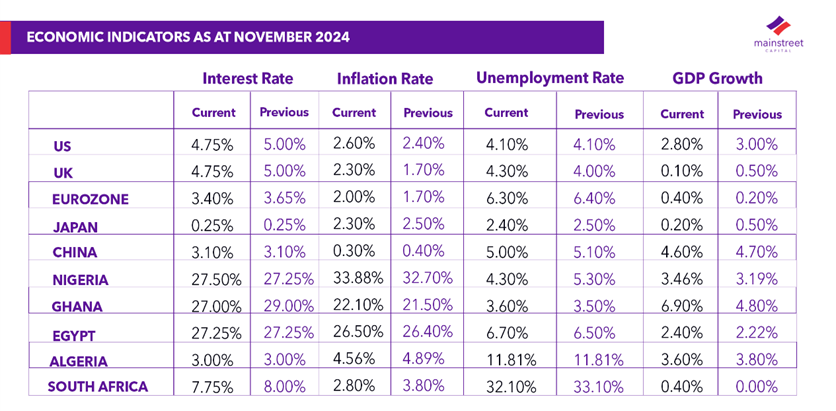

Below are recent and previous economic indicators such as interest rate, inflation rate, unemployment rate and gross domestic product for select countries.

(*Eurozone is a union of 20 countries that the European Union has adopted the Euro as their currency.)

Global Economic Changes: Europe, Asia & Africa

The eurozone faces increasing pressure as trade relations with the US worsen, and economic conditions continue to slide. The euro has fallen against the dollar, and approaches parity. In the global economy, while interest rate cut was the policy used by Central Banks to tame high level of inflation, rate decisions in coming months may be hawkish.

In Africa, the Economic Community of West African States (ECOWAS) has introduced the digitalized ECOWAS electronic Certificate of Origin to streamline trade across the continent, supporting the goals of the African Continental Free Trade Agreement.

Chevron, a global oil and gas corporation, is focusing more on West Africa, including Nigeria and Angola, in anticipation of a production increase in these oil-rich nations. The global oil company is the supplier for Dangote refinery’s resumed imports from the US.

In Asia, China’s services sector picked up a bit thanks to a major stimulus push. Economic growth projections are still lower than the initial 5% target, and stimulus packages focus more on restructuring government debt than bolstering manufacturing and real estate.

Industrial profits continue to decline, signaling that recovery is still fragile. Meanwhile a 10% drop in China’s industrial profits is a reminder that the road to recovery will be slow and bumpy.

Let’s move on to Nigeria.

Nigeria’s Budget and Financial Concerns

The 2025 budget is pegged at a staggering ₦47.9 trillion. Due to the naira’s devaluation, that’s roughly $27.96 billion, down nearly 18% from the previous year. As oil prices fluctuate. This month, the Senate approved a $2.2 billion external borrowing plan to address a significant budget deficit.

In a positive turn, local crude oil production increased to 1.43 million barrels per day in October, though still short of its OPEC target. Also, the Port Harcourt refinery resumed operations in November as the FG tries to revamp refineries. Since oil exports are a major source of revenue, these developments could translate to increased earnings for the country.

Equities Market: Mixed-to-Bearish Sentiments

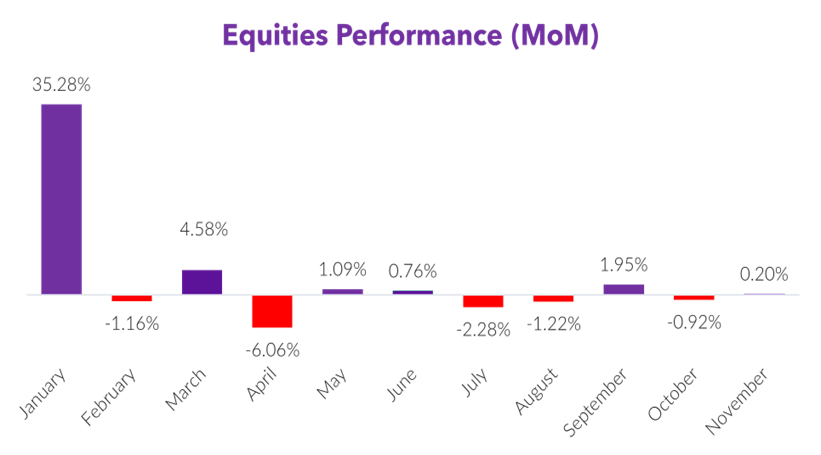

The equities market has fluctuated around the current support level at 97,000 points as investors show mixed sentiments in the short term. The market index started November on a decline and while the index trades slightly higher, investors are still cautious despite boosts from the banking and insurance sectors.

The market showed signs of turbulence, with earnings reports highlighting the increasing cost of operation for companies in the consumer goods sector. On the other hand, banks reported large profits as high interest rates boost interest income.

Meanwhile, Access Bank made a strategic acquisition of a majority stake in Afrasia Bank and completed its acquisition of Standard Chartered branched in Angola and Sierra Leone, marking a significant expansion.

Speaking of banks’ expansion, Zenith Bank Plc opened a Zenith Bank (UK) branch in Paris, United Bank for Africa signed a deal with the French Government to commence full banking operations in France and First Bank of Nigeria Plc plans to expand its operations in China to include Guangdong and Shanghai, in addition to its current presence in Beijing. Seems Nigerian banks want to take over the world.

The stock market’s positive performance in January 2024 (up 35.28% m/m) is the largest monthly gain in 2024, as bullish investor sentiment from the last month of 2023 continued in early 2024.

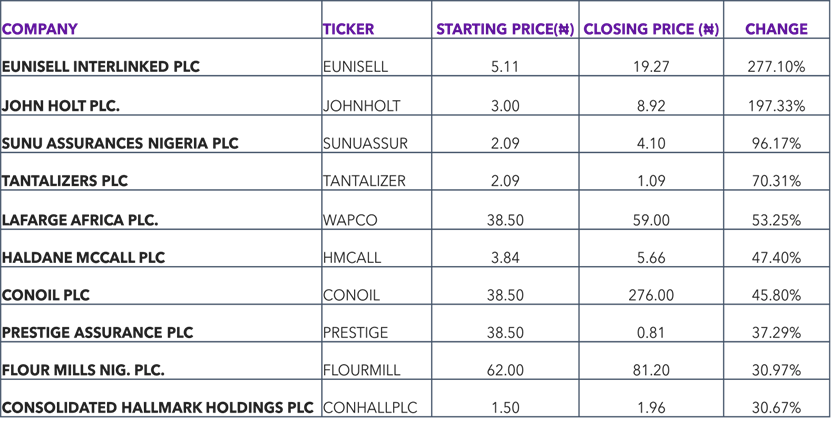

Top Stock Price Gainers in November 2024

(*The above represents data at the end of equities trading on November 28, 2024)

Interest Rates and Central Bank of Nigeria Updates

The Central Bank of Nigeria (CBN) continues to adjust its policies. The 25bps hike in the Monetary Policy Rate (MPR) to 27.50% signals a tightening stance. CBN also rolled out new forex trading systems, aiming at market efficiency.

Additionally, CBN initiated a bold strategy to streamline its foreign exchange market by introducing the Bloomberg BMatch system, set to be launched in December 2024. CBN also sent $100,000 at the minimum for banks to trade FX. Though the Apex bank’s monetary policy stance was the hike rate this year, it did not address the rising inflation it was intended to. Recent data for inflation places it at 33.88%, as food costs and transport costs exert pressure on consumers.

Nigeria’s Economy: An Uneven Growth

The economy grew by 3.46% in the third quarter of 2024, higher than the 3.19% growth recorded in the second quarter. However, a closer look at the numbers tells a story of uneven growth, with significant variations between sectors, highlighting both resilience and vulnerability in the Nigerian economy.

The oil sector, a key source of revenue for the country, faced a setback in the third quarter of 2024. Its growth slowed yet it represents a significant improvement over the same period in 2023. Its contribution to the overall Gross Domestic Product was lower than in the previous quarter.

The Agricultural sector is pertinent as individuals require necessities which include food. Contributions of the agricultural sector to the GDP improved, largely due to the growth in the livestock subsector, which has seen steady expansion, particularly in the latter half of the year. The increased demand for livestock ahead of the festive season could drive further growth in the coming months.

Agriculture continues to grapple with persistent insecurity and flooding, which has disrupted crop production. Businesses in the Trade sector are similarly burdened with foreign exchange liquidity issues and rising local prices eroding margins. The combination of these factors has dampened the sector’s growth potential, despite Nigeria’s continued reliance on agricultural exports.

On the other hand, the services sector now accounts for more than half of Nigeria’s GDP (53.58%) as at Q3-2024, though this is down slightly from 58.76% in Q2-2024. The sector’s dynamism contrasts with the challenges facing other parts of the economy, particularly agriculture and trade.

The recent GDP growth data paints a picture of an economy that is growing, but in an uneven manner. While there’s growth in the non-oil sector, this expansion is far from uniform. Some sectors, particularly finance, have benefited from favourable economic conditions such as higher interest rates and inflation, while others, like agriculture, are facing the brunt of rising raw material costs and higher loan rates.

Reader’s Corner

“If months had personalities, November would be that friend who always brings snacks.”

November is that crucial prelude to the year-end sprint. The holidays are approaching, but there’s still time to seize those gains.

Have you positioned yourself for the final stretch? Remember, as Robert Kiyosaki wisely put it, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

The Nigerian economy faces a delicate balancing act. While the financial services sector is poised to continue its strong performance, the agriculture and trade sectors will need to navigate the ongoing challenges of insecurity, inflation, and foreign exchange liquidity issues.

That’s all folks! Stay diversified with effective investment strategies because the market never sleeps. Until next time, happy investing!

“Alexa, play… ♫ Its beginning to look a lot like Christmas… ♫ “

To Stay tuned for more updates; follow Mainstreet Capital on social media ( LinkedIn | X | Instagram | Facebook ) and fill this form to subscribe to our newsletter. Remember, the more you learn, the better equipped you’ll be to make sound investment decisions.

Until next time, happy Investing!