This year has been one for shifting economic landscapes in Nigeria as key governmental reforms are painting new realities for business, citizens, and the country.

As the second quarter comes to a close, here are some insights to keep in in mind in Q4-2025.

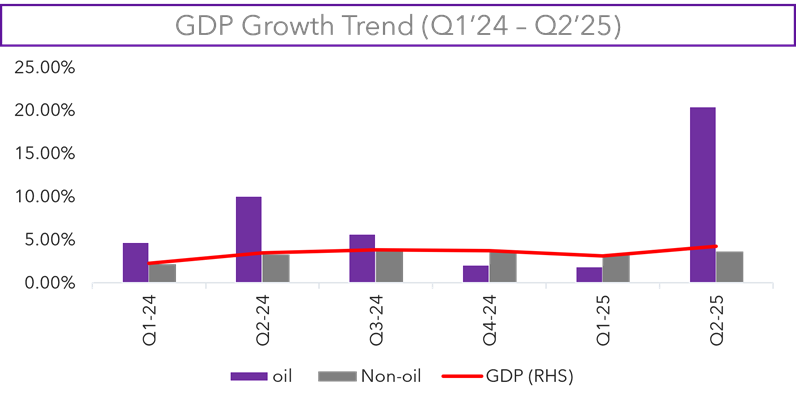

GDP prints higher in Q2-2025

Q2-2025 GDP reports showed a 4.23% economic growth driven largely by the services sector, but with agriculture making a comeback.

The oil sector recorded significant growth due to new efforts by the government to increase crude production capacity over the quarter. Crude oil exploration grew 20.46% over the second quarter as production averaged 1.68mbpd, higher than 1.62mbpd in Q1-2025.

Meanwhile, oil refining also grew by 15.78% over the quarter with the activities of Dangote Refinery contributing significantly to this growth.

The non-oil sector recorded a 3.64% growth, with trade, crop production, real estate, telecoms, construction, and livestock production being the largest contributors to growth.

Insights

Agriculture recorded significant growth thanks to crop production which grew by 3.32% over the quarter.

This growth coincides with Agricultural PMI recorded expansion in the sector over the last 6 months; which means growing orders, higher output, and even higher employment levels over the quarter.

Livestock farming also recorded a 1.64% growth, much better than -16.46% contraction seen in Q1-2025. While the Q1 contraction trend appears to play out historically, we see a smaller contraction in Q1-2025 and higher growth in Q2-2025, making us optimistic about the sub-sector.

If you’re looking for a sector to watch out for, agriculture is one of them.

Trade recorded modest growth, but exports continued to rise.

Trade recorded a 1.26% growth rate over the quarter, which was slower than 1.78% in Q1-2025. However, total exports rose to ₦22.75 trillion from ₦20.59 trillion in Q1-2025 and outpaced imports which was ₦15.28 trillion, leaving a positive balance of ₦7.46 trillion, the largest we’ve seen since 2020

Mineral resources are the most exported item by a landslide, comprising ₦19.87 trillion (or 87.34% of total exports) followed by Beverage, Spirits, and Vinegar with export volumes at ₦725.89 billion (3.19%), and Chemical products with export volumes at ₦633.02 billion (2.78%). Honorable mention: Vegetable products: ₦622.23 billion (2.73%).

Net exporters are tilting the scales. Keeping an eye out for them sounds like a good idea.

Telecomm activities peak in Q4.

Historically speaking, the telecom sector records the highest output level in the last quarter of the year. In 2023, this was a recorded ₦6.09 trillion, and in 2024, it was ₦7.38 trillion. With Q2-2025 output already at ₦7.77 trillion, there’s room for an increase.

While growth rates may not rise with output due to price deflators, an increase in activities may spell more profits for providers.

Smaller industries are rising

Several smaller industries recorded significantly higher growth rates as output levels rose considerably due to a stable FX landscape, an expanding business environment, and efforts to secure value chains.

One worth watching is Coal Mining, which recorded a 57.53% growth rate in Q2-2025 from a -22.28% contraction in Q1-2025. However, be watchful, as peak output is usually in Q2-2025, which means that growth rates may dwindle for the rest of the year.

Nonetheless, Coal mining ties in with mineral resources, which account for the bulk of exports.

Other industries that recorded significantly higher growth rates include Quarrying and Other Minerals (+45.86%), Rail Transportation and Pipelines (+43.08%), and Water Transportation (+27.90%).

GDP reports don’t just tell us which parts of the economy grew in the recent past. Combined with other data points, it provides insights that can be used to make smart financial decisions.

To Stay tuned for more updates; follow Mainstreet Capital on social media ( LinkedIn | X | Instagram | Facebook ) and fill this form to subscribe to our newsletter. Remember, the more you learn, the better equipped you’ll be to make sound investment decisions.