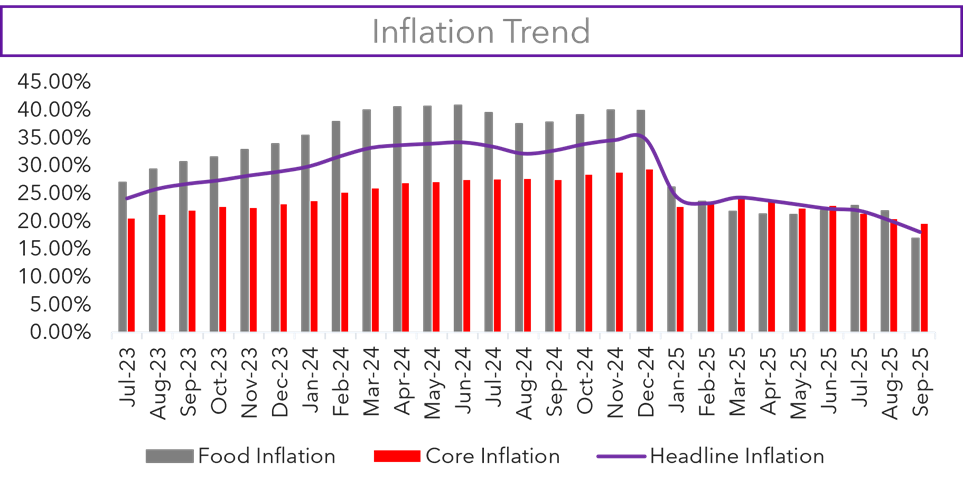

The National Bureau of Statistics (NBS)’ inflation report for September 2025 showed a 211bps decline to 18.02% from 20.12% in August 2025 because of a significant decline in food inflation.

Food inflation fell to 16.87% from 21.87% in August, a 500bps drop as the prices of staple foods fell (according to the report). Monthly food inflation, which tracks m/m changes in general food prices printed -1.57% which means that prices declined).

Meanwhile, core inflation fell 80bps to 19.53% from 20.33% in August despite a rise in the monthly services index as transport costs eased.

The recent inflation figures has far-reaching implications across various industries, many of which affect investors. Here’s a rundown of the major effects to watch out for.

Monetary Policy Rate and Fixed Income Yields

The CBN recently slashed rates to 27.00% from 27.50% in line with declining inflation. The CBN’s stance has shifted in recent months from maintenance to growth, which could involve looser monetary policy moving forward. If this happens, fixed income yields will compress further. For context, 10-year benchmark yields began the year around 21.75% and has declined to 15.57% as of writing in October 2025.

Note that the bulk of this decline was during a period where the CBN kept rates constants and adjusted stop rates at primary auctions.

However, the prime directives: to keep rates low enough to support cost-effect borrowing and to manage inflation, remain consistent. With inflation at 18.02% (and expected to ease further), we reckon the CBN will be more inclined to further lower rates, which could further compress fixed income yields on the secondary markets.

Equities and Company Earnings

Lower inflation exerts the opposite effect on companies than it does on fixed income yields as it often translates to a lower cost of doing business, provided the cost of inputs also experience disinflation.

However, a lower monetary policy combined with falling inflation translates to even more cost savings as the cost of borrowing money falls, which can be beneficial for company earnings.

This logic works better when industry revenue growth rates are on the rise and (Purchasing Managers’ Index) PMI reports support business growth. Composite PMI for September printed 54.0 which is in expansion zone, especially for capital intensive businesses like those in the industrial sector (industry PMI was 51.0) essentially showing growth in business activities.

So far, the (Nigerian Exchange All-Share Index) NGX ASI has returned above 45.00% as businesses logged strong revenues in the first half of the year.

The Banking Dilemma

While banks are companies, they suffer the same fate as fixed income assets because of their business type. In 2025, bank revenues are generated from two main sources: interest income from lending and interest income from investment securities.

Higer interest rates usually result in higher profits for banks as they can charge more per loan. Also, the cost of banks’ funds rarely rise even in high-interest rate environments (most people don’t deposit money in banks for the interest, but because they need a place to store funds).

In a low-rate environment, bank revenues from lending are expected to compress depending on how aggressively the CBN slashes rates. While lower rates could encourage more lending (more average loans issued), total revenue from lending have historically declined.

Interest income from investment securities is directly affected by the yields of government securities. If the 10-year benchmark yield falls from 21% to 15%, that means income from these securities also dwindle as new security purchases will be at lower yields.

Daily Life

Lower inflation should mean that the prices of goods and services decline, this is not always the case in daily life as inflation does not apply equally to all sectors, states, goods, and services. As such, a decline in inflation to 18.02% from 20.12% does not mean that the cost of everyday items has declined. In truth, costs are still on the rise, just at a slower pace compared to last month. To see a general reduction in prices, inflation would have to print a negative figure. This term is called deflation, which is a monetary decline in the cost of goods and services.

We saw deflation in the m/m prices of food items (-1.57%) and farm produce (-0.68%), which means that food items from farms should have been cheaper in September compared to August, but that may not be applicable in equal measure to all farm items in all states across the nation.

Putting it All Together

Consistently lower inflation is setting a precedence, one that may involve lower interest rates in the weeks and months to come.

Fixed income investments are expected to see compressed yields over the next several weeks, provided inflation continues a downtrend and the CBN slashes rate further.

Equity investments could rise, but this also depends on sectors and the individual companies within them.

To Stay tuned for more updates; follow Mainstreet Capital on social media ( LinkedIn | X | Instagram | Facebook ). Remember, the more you learn, the better equipped you’ll be to make sound investment decisions. For more information or personalized investment strategies that take advantage of the new economic realities, book a session with our expert asset managers.