The financial markets are offering a spectacle that even the most seasoned investors will find intriguing. In this article, we turn our focus to the fascinating world of financial markets, with a particular focus on the bond market. Whether you’re sipping a single malt or enjoying a freshly brewed espresso, settle in as we dissect why bonds might be relevant to you now.

“People worry about the riskiness of stocks, but bonds can be just as risky.”

— Peter Lynch

Why Bonds Now?

At their core, bonds are essentially IOUs given by either governments or corporations in exchange for your money. These IOUs promise to return your principal after an agreed upon period (called the tenor) and pay interest on the borrowed amount. While they are different compared to the stock market’s rollercoaster, they hold their own unique allure. Government Bonds which are issued by governments, Corporate Bonds which are issued by corporations, offer different ways of diversifying and stabilizing your portfolio.

Government Bonds in Focus: “A New Kind of Domestic Bond”

In Nigeria, all domestic bonds are issued in naira. If you want a dollar-denominated bond, you’d have to buy a Eurobond, which has a minimum volume of $100,000. That’s a lot of Cheddah. Well, not anymore.

The first Domestic Dollar Bond issuance of $500 million by the Nigerian government is underway, offering a 9.75% interest rate per annum with the aim of funding government infrastructure plans. The market’s reaction to this development is worth monitoring, especially for Nigerians within the country and in the diaspora, as well as institutional investors.

Unlike the Eurobond with a steep minimum limit, this Domestic Dollar bond has a minimum subscription of $10,000 with subsequent $1,000 increments.

Stock Market Volatility: A Global Snapshot

The US stock market faced its own set of challenges, reflecting a cautious investor sentiment. A major event was the Japanese carry trade unwinding, which involves caused close to $4 trillion of funds to exit the markets, $1.4 trillion of which was from the US equities market.

What is the Yen Carry Trade?

The Yen carry trade is a strategy that involves borrowing Yen from Japanese banks at abysmally low rates, converting it to other currencies with much higher interest rates, and investing those funds in assets that offer higher yields.

The top currency of choice? US Dollars.

The point is to get yields that are much higher than the borrowing costs of the Yen, and this worked, until the Bank of Japan raised interest rates.

The higher borrowing cost of the Yen rendered many carry trade positions less profitable, so people started to sell and convert their dollars to Yen, which strengthened the value of the Yen against the dollar, which made even more carry trade positions unprofitable (foreign exchange losses).

The result was a cascading selling event that wiped $1.4 trillion from the US stock market.

However, the resilience of the US economy is unmatched; the market quickly recovered and the S&P500 is set to close August in the green (the verdict is still out on the Nasdaq).

European Market: Eurozone business activity saw a slight uptick, thanks in part to the Paris Olympics. However, manufacturing continues to face headwinds.

Japan: Japanese stocks saw modest gains. The Bank of Japan’s commitment to monetary policy normalization and a hawkish stance on core inflation continues to influence market dynamics.

China: Chinese stocks declined as economic data underwhelmed and Fed Chair Powell’s speech hinted at potential rate cuts. The People’s Bank of China may adjust its rates accordingly if the Fed acts.

Beyond the Headlines

Duty-Waiver for Select Food Imports

Nigerian Customs has introduced a duty waiver on essential food imports, effective from July 15 to December 31, 2024, which is expected to lower costs for businesses, especially in the FMCG sector, potentially improving their performance in early 2025.

What Does an Increased GDP Rate Translate to?

Nigeria’s GDP grew by 3.19% in Q2 2024, signalling progress amidst economic challenges. While high interest rates, inflation, and forex issues pose difficulties, sectors like finance and professional services are thriving, hinting at selective growth opportunities.

Central Bank Moves Again

The Central Bank of Nigeria has lifted the suspension on the Standing Lending Facility and adjusted interest rates, now up to 25.75% on deposits. This follows a July Monetary Policy Committee decision to increase the Monetary Policy Rate.

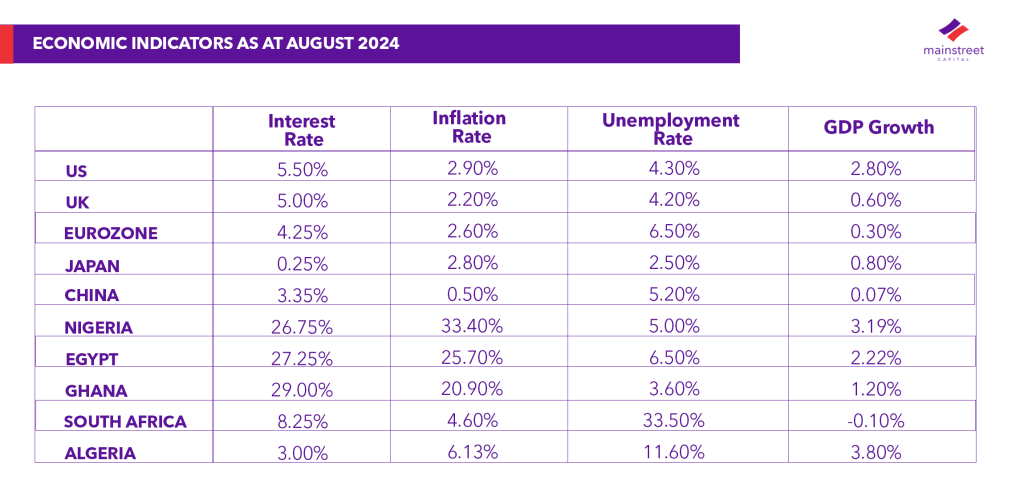

ECONOMIC INDICATORS FOR SELECT MARKETS AT AUGUST 2024

To Stay tuned for more updates; follow Mainstreet Capital on social media ( LinkedIn | X | Instagram | Facebook ) and fill this form to subscribe to our newsletter. Remember, the more you learn, the better equipped you’ll be to make sound investment decisions.